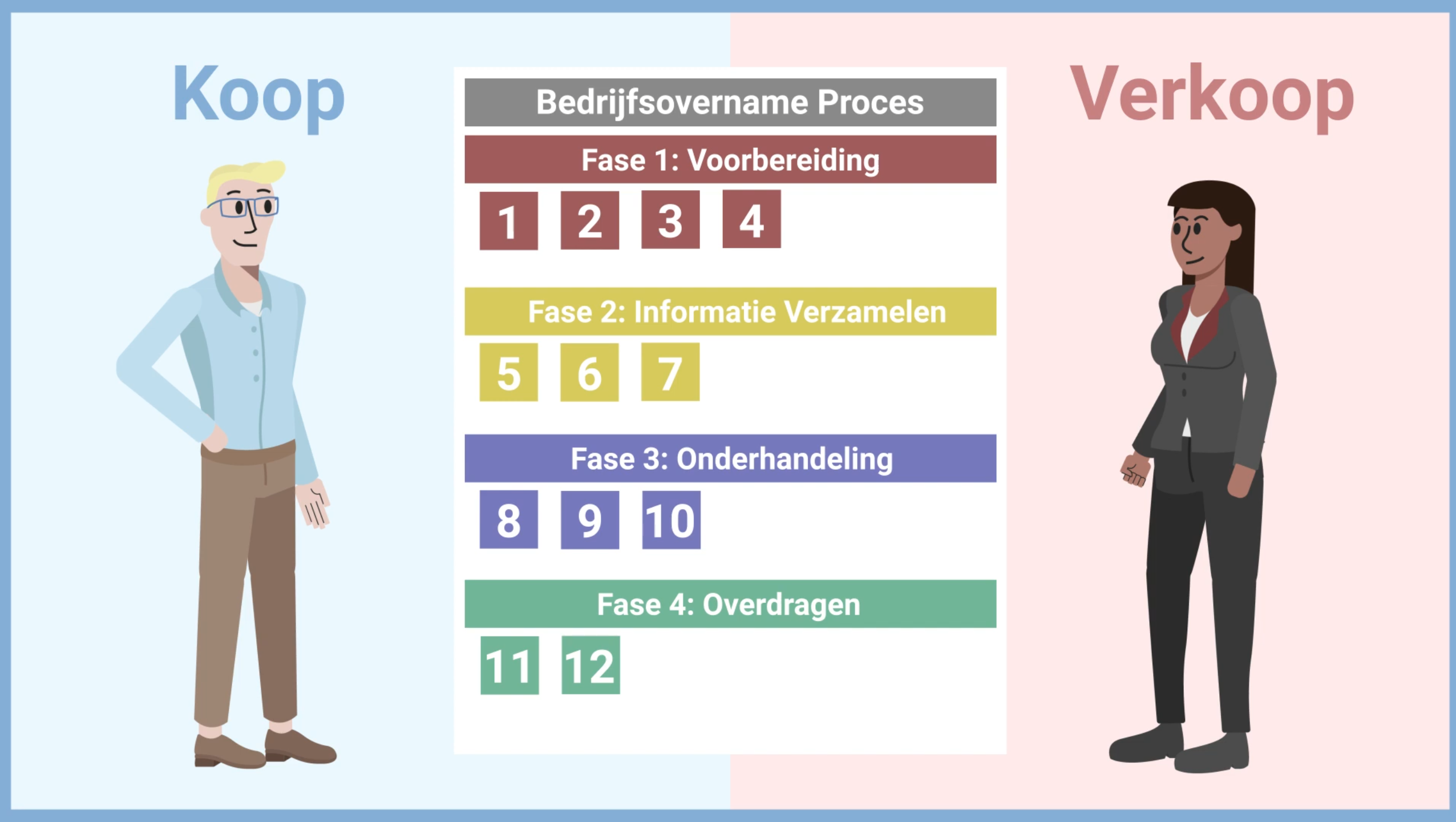

A business transfer knows two sides: a buy and a sell side. Even though every business takeover is different, there are a few steps that are present in any business takeover process. In short, the business takeover process can be divided into the following steps:”

- The orientation phase:In this phase, longlists and shortlists are often made of potential buyers and sellers. An advisor can often help with this, together with the entrepreneur.

- The preparation phase:The seller will prepare the company for selling by, for example, making sure the administration is completely up to date. Buyers will do preparatory research in what financing options are available. During the preparation phase, often various companies are approached formally or informally.

- Signing of the nondisclosure agreement:Before the process continues, it can be important to agree between both parties to keep all conversations confidential and even agree to an exclusive period in which both parties talk exclusively with each other and not with other interested parties concerning the buying or selling.

- The meeting between buyer and seller:In this phase, the first formal conversations take place, often in a neutral environment.

- Exchanging information:this follows swiftly after the meeting and generally includes revenue, profit margins, staff, assets, and debts.

- The company’s valuation and the bidding:The value of the company gets determined, which knows many methods. These methods are explained into detail in another blog.

- The negotiation: This is an exciting process. It is important to set a minimum, or maximum, price, and keep spare compromises and change in mind.

- The drafting and signing of the letter of intent: Here one expresses the intention the buy or sell the company to the other party, subject to a number of conditions.

- Financing:mixed sources of financing through the bank, crowdfunding, personal loans, family capital, subordinated loans, or other sources, can be used.

- Performing the due diligence:Here, the buyers looks into the detailed accountancy reports to see if there are no special cases that were not mentioned before.

- Drafting and singing the purchase agreement:Here, the final terms and conditions are drafted for all parties involved. This is strongly determined by the previous accountancy due diligence.

- The transfer:here starts the new phase for the buyer, and it signals the ending of ownership of the company for the seller.

The transfer process is a complicated matter. It is important to be guided through these various phases by advisors.